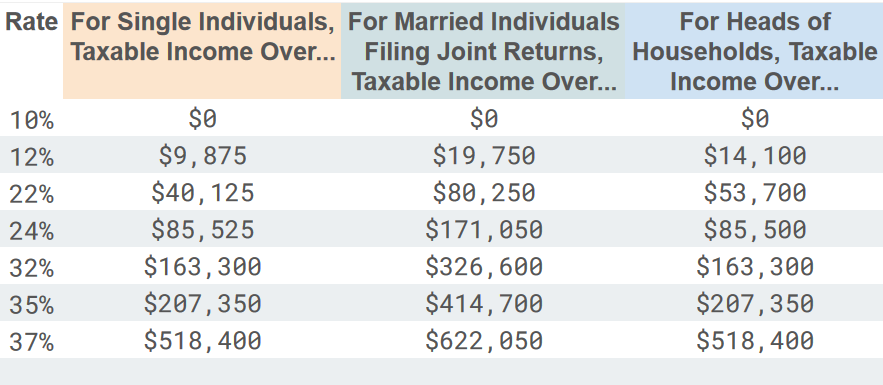

The lower rates apply to income in the corresponding brackets. For instance, if you’re single and your taxable income is $300,000 in 2022, only the income you earn past $215,951 will be taxed at the rate of 35% shown on the corresponding federal income tax chart above. The tax rate of your total income applies only to the income earned in that bracket. Remember that the tax rates are marginal. So when you file in 2026, rates will go back to those before Trump’s 2018 changes. Individual tax provisions are going to expire after 2025. This exemption refers to the maximum amount you can give in lifetime gifts and bequests at death without having to pay a 40% tax. Estate Taxes: More than doubled the estate and gift tax exemption from $5.49 million in 2017 to $12.06 million in 2022 (going up to $12.92 million in 2023).Child Tax Credit: Doubled the maximum child tax credit to $2,000 for each qualifying child younger than 17 years old, and made it available to higher-income households.But, if your total itemized deductions don’t exceed Trump’s higher standard deduction, you won’t be able to take it. In 2017, taxpayers under 65 could only deduct expenses that exceed 10% of their AGI. Those that exceed 7.5% of your AGI are deductible. Qualified Medical Expenses: A lower threshold for qualified medical expenses.In 2017, you could claim a $4,050 deduction for yourself and each qualifying dependent in your household. Personal Exemption: The personal exemption was eliminated.Standard Deduction: The standard deduction has more than doubled, going from $12,700 (2017) to $25,900 (2022) for married couples filing jointly from $6,350 (2017) to $12,950 (2022) for single taxpayers and married individuals filing separately from $9,350 (2017) to $19,400 (2022) for heads of households.Other notable Trump tax overhaul changes include: Now the highest rate, which is just 37%, applies to income over $539,900 for single people and $647,850 for joint filers. The highest tax bracket used to carry a 39.6% rate and apply to single people earning more than $418,401 and married couples filing jointly who earned more than $470,701 in taxable income. You also get a tax break if you’re among the country’s highest earners. In 2018, 2019 and beyond, that rate dropped to 12%.

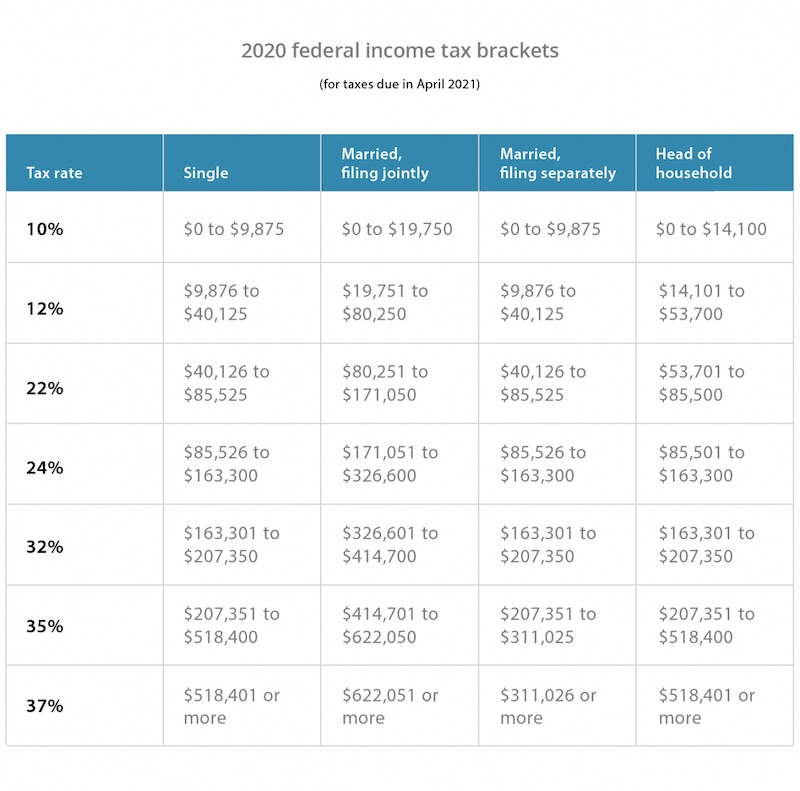

A single person making $39,000 in taxable income in 2017 saw a rate of 25%. Those who earn less may also see a bit of a break. That led to a fairly significant difference in take-home pay. For 2018, 2019 and beyond, their highest tax rate is just 24%. A married couple whose total income minus deductions is $250,000 would have had a 33% tax rate in 2017. The biggest changes under the new Trump tax plan came from those in the middle of the chart. Here’s a breakdown: 2017 Federal Income Tax Brackets (Pre-Trump Tax Laws) If you know your yearly income, you can see how the new plan changed your tax rate from before. 2022 Federal Income Tax BracketsĪnd for another comparison, the chart below shows the tax brackets for 2017. This could also mean that you will pay a different tax rate on part of your income for your 2022 return. And as a result, you might find yourself in a different tax bracket for 2022 than you did for 2021. Note that the brackets are adjusted from year to year for inflation. Now, compare the 2022 tax brackets above with the 2020 brackets below. All other income is taxed at lower rates. Instead, federal income taxes are marginal, meaning your tax rate only applies to the portion of income that falls directly within that bracket. If you’re in the 22% tax bracket, you don’t pay a 22% tax on all of your earnings. Remember, federal income tax is not assessed at a flat rate. If you know your yearly income, you can figure out your tax bracket and see what your rate is for your 2022 taxes. The chart below shows the tax brackets from the Trump tax plan. However, these new brackets, rates and general tax laws instituted by the Trump Administration will expire in 2025.

Many workers noticed changes to their paychecks starting in 2018 when the new tax rates went into effect.

0 kommentar(er)

0 kommentar(er)